Financing Guide

Home buying or selling can be quite overwhelming. There are a lot of things to consider such as Financing, Loans, which lender to go for, can you afford it, how much would you pay, etc. Luckily I got you covered. Here is a step by step guide towards Financing.

STEP 1

Pre-approval

Pre-approval for a mortgage loan is a critical step in the home-buying process for several reasons. Here's why it matters:

1. Establishes Your Budget

Know Your Price Range: Pre-approval helps you understand how much you can borrow, which in turn defines the price range of homes you should consider.

Avoid Overstretching: It prevents you from looking at homes that are beyond what you can afford, saving time and emotional stress.

2. Demonstrates Seriousness to Sellers

Shows Credibility: A pre-approval letter signals to sellers that you are a serious buyer with the financial backing to make an offer.

Enhances Negotiation Power: Sellers may prioritize your offer over others because they know financing is likely secured.

3. Speeds Up the Buying Process

Streamlined Purchase: With pre-approval, the mortgage process moves faster once your offer is accepted.

Fewer Surprises: You’ve already provided key financial documents, reducing potential delays during underwriting.

How to Get Pre-approved

1. Gather Financial Documents: Prepare your pay stubs, W-2 forms, tax returns, bank statements, and debt details.

2. Choose a Lender: Research and compare lenders to find favorable terms and rates.

3. Submit Application: Complete a loan application and provide requested documentation.

4. Receive Pre-approval Letter: Once approved, you'll receive a letter specifying the loan amount and terms.

STEP 2

Loan Process

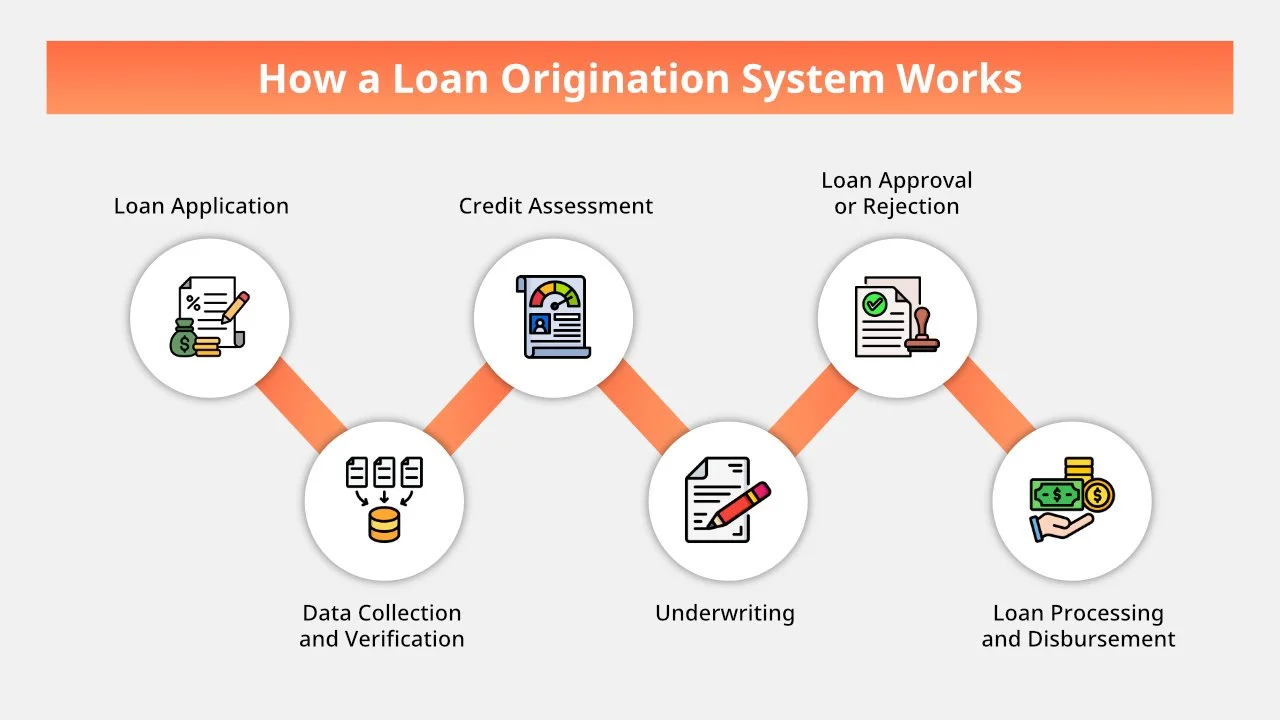

Each stage of the loan process is essential to ensure that:

The borrower can afford the loan without financial strain.

The lender mitigates risk by confirming the borrower’s ability to repay.

The property’s value justifies the loan amount.

Focus on finding the right lender. Fill up the form below to start

I agree to be contacted by Elizabeth Platt PA via call, email and text. To opt out, you can reply “Stop” at anytime or click the unsubscribe link in the emails. Message and data rates may apply. Messages frequency varies. Privacy Policy

My Recommended Lender

Dan Ribler

Hi , I’m Dan! I’ve worked in mortgages since 2007, and I’ve seen just about every market cycle imaginable. When not working on mortgages, I like going to the gym and fishing. I wouldn’t be upset about having a beer while watching sports either.

STEP 3

You’re almost there!

Application and Processing

Once you find your ideal property and your offer is accepted, the next step is to complete a full mortgage loan application. Your lender will guide you through the process, discussing down payment options and detailing any associated fees to ensure clarity and transparency.

After submitting your application, the processing phase begins. During this stage:

Your financial documents are thoroughly reviewed to confirm accuracy and completeness.

The lender orders a home appraisal to verify the property's market value.

A title search is conducted to ensure the property has no outstanding liens or legal issues.

The final step in the application process is underwriting. Here, the underwriter reviews the entire loan package, checking for compliance with all lending guidelines and regulations.

It’s common during this phase for your lender to request additional documentation or clarification to address any discrepancies or meet specific requirements. Responding promptly to these requests will help keep the process moving smoothly.

STEP 4

The last step:

SIGNING THE DEAL!

After your loan is approved, the final steps bring you closer to owning your new home. Here’s what to expect:

Set Up Homeowners Insurance:

Secure a policy to protect your property. Lenders typically require proof of insurance before closing.

Prepare for Closing:

Your loan documents will be sent to the title company. A closing date will be scheduled for you to review and sign the necessary paperwork.

Closing Day:

At the closing, you’ll sign legal documents, including the loan agreement and title transfer.

You’ll also pay any remaining costs, such as closing fees and the down payment.

Final Recording:

After the closing, the transaction is officially recorded with the local government. This step finalizes the transfer of ownership.

Once the recording process is complete, the home is officially yours, and you can celebrate becoming a homeowner!